- Blog

- How to Import a Car to Romania

How to Import a Car to Romania

Discover the complete process of importing cars to Romania, from understanding regulations and taxes to handling documentation. Perfect for car traders!

Are you a car trader from Romania looking to import cars from the EU? Importing cars to Romania can be a profitable venture, but it's important to understand the process.

This guide will walk you through the steps, regulations, and paperwork needed to successfully import vehicles into Romania.

As a car trader, you'll find that Romania's growing economy and increasing demand for quality used cars make it an attractive market.

However, navigating the import process can be tricky. Don't worry - we've got you covered with all the essential information you need to know.

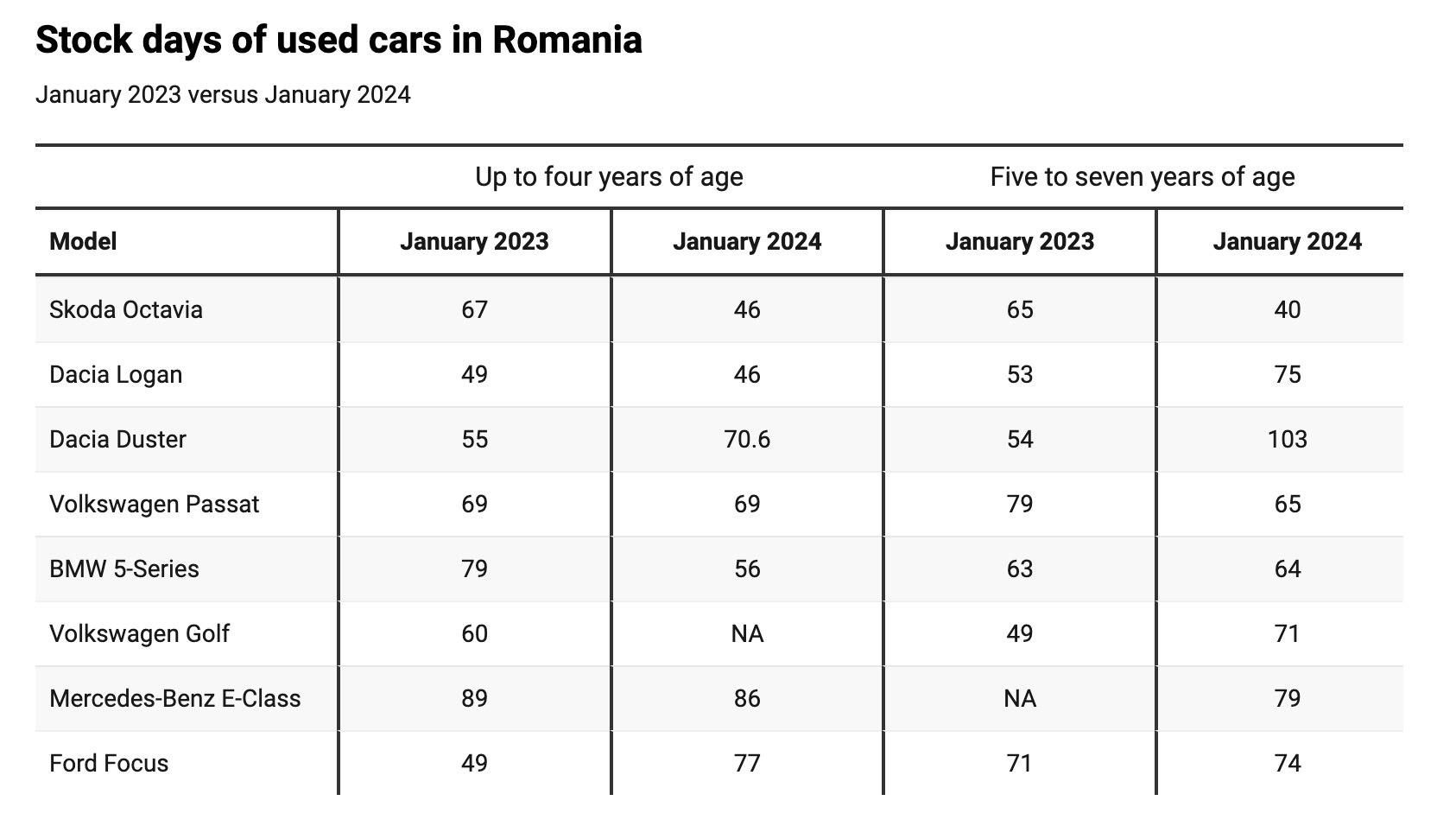

Get to know the Romanian used car market

Understanding the Romanian used car market is crucial for success in the import business. Romania has experienced a significant uptick in demand for second-hand vehicles over the past decade.

According to recent data from Autovit, a little over 300,000 used cars were imported from abroad and registered in Romania in 2023.

The used car market in Romania has continued to experience a 5.1% growth in 2024 compared to the same period the previous year.

In the first half of 2024, Dacia was the most popular brand for second-hand cars in Romania, with over 26,000 vehicle registrations. Toyota came in second with around 7,100 registrations, followed by Renault with approximately 5,800.

Historically, diesel engines have been the preferred option due to their perceived fuel efficiency. However, petrol engines are also gaining ground, and hybrid vehicles are seeing a surge in popularity in urban areas.

The average age of imported used cars in Romania hovers around 8-10 years. Buyers seek a balance between affordability and relatively modern features and cars in this age range often offer good value for money.

Interestingly, the market shows regional variations. In Bucharest and other major cities, there's a growing trend towards newer models and alternative fuel vehicles. In contrast, rural areas still show a strong preference for older, more affordable diesel vehicles.

As a car trader, it's crucial to keep an eye on these trends and tailor your imports accordingly.

Romania's import regulations

When it comes to importing reliable used cars to Romania from other EU countries, you'll need to navigate a specific set of regulations. These rules are designed to ensure that imported vehicles meet Romanian standards and that all necessary taxes are paid.

- First and foremost, Romania allows the import of used cars that meet at least Euro 4 emission standards. While Euro 4 is the minimum, vehicles meeting higher standards (Euro 5, Euro 6) are increasingly preferred and may face lower taxes.

- All imported vehicles must be right-hand drive to be road-legal in Romania. Left-hand drive vehicles are not permitted for regular use on Romanian roads, which is an important consideration when sourcing cars for import.

- The age of the vehicle can also impact the import process. While there's no strict age limit, cars older than 8 years may face potentially higher taxes.

- Cars that have been previously declared as total losses or have undergone major structural repairs may face difficulties during the import process. Romanian authorities require a clean vehicle history to ensure road safety.

- All imported vehicles must undergo a technical inspection in Romania before they can be registered. This inspection ensures that the vehicle meets Romanian road safety standards. While a recent inspection from another EU country can be helpful, it doesn't exempt the vehicle from undergoing the Romanian inspection process.

As regulations can change, it's advisable to regularly check with official Romanian sources, such as the Romanian Auto Registry (RAR) or the Ministry of Transport, for the most up-to-date information.

Staying informed about these regulations will help you avoid potential pitfalls and ensure a smoother import process for your car trading business.

Documentation for importing vehicles to Romania

When importing vehicles to Romania as a car trader, proper documentation is crucial. Let's break down the key documents you'll need, with detailed explanations for each.

Vehicle purchase invoice

The vehicle purchase invoice is your proof of ownership and the starting point of the import process. This document should clearly state:

- The full details of the seller (name, address, VAT number if applicable)

- Your business details as the buyer

- Complete vehicle information (make, model, year, VIN number)

- Purchase price and currency

- Date of purchase

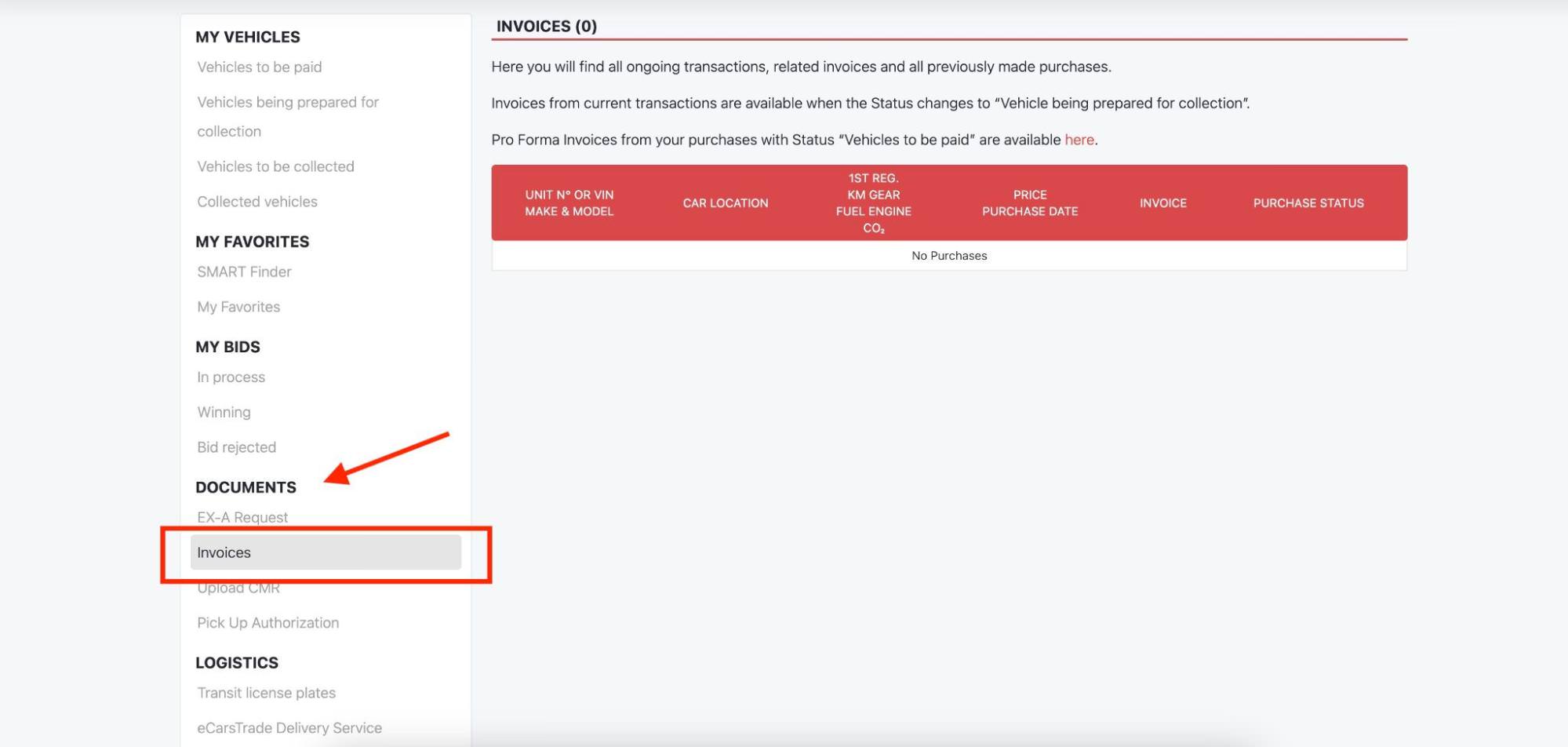

You can download all your invoices through your Personal page on eCarsTrade.

Certificate of Conformity (COC)

The European Certificate of Conformity is a critical document that proves the vehicle meets EU standards.

Not all cars on eCarsTrade come with a COC, like cars from France. If your purchase car is not provided with a COC, worry not.

You can utilize online services such as EuroCOC to obtain your Certificate of Conformity.

Original vehicle registration papers

All cars on eCarsTrade come with their original registration papers from the vehicle’s country of origin that show the vehicle's technical details, previous owners, and registration history.

They won’t be in Romanian, however, so you will need a certified translation for the import process.

Proof of insurance

Valid insurance coverage is mandatory for importing and registering a vehicle in Romania, especially if you are picking up the vehicle yourself and transporting it to Romania with transit license plates.

You'll need at least third-party liability insurance and the policy should be valid for Romania and cover the period of import and registration.

If you're driving the vehicle into Romania, ensure your insurance covers the transit journey

Once in Romania, you'll need to obtain Romanian insurance before the final registration.

Customs declaration

The customs declaration is your formal statement to Romanian authorities about the imported vehicle. It includes:

- A detailed description of the vehicle

- Its value and origin

- The purpose of import (in this case, for commercial purposes)

- Your business details as the importer

Be accurate and thorough when filling out this form, as any discrepancies could lead to delays or fines.

Business identification documents

As a car trader, you'll need to provide documentation proving your business status:

- Company registration certificate

- Tax identification number (CUI in Romania)

- VAT registration certificate (if applicable)

- Power of attorney if someone is handling the import on behalf of your company

Technical inspection report

A technical inspection report confirms the vehicle's roadworthiness.

If the vehicle has a valid technical inspection from another EU country, it might be accepted, but verify this with Romanian authorities.

Otherwise, you'll need to obtain a Romanian inspection (ITP) before registration. This document is essential for ensuring the vehicle meets Romanian safety and environmental standards.

Taxes when importing a car to Romania

Understanding the tax landscape is crucial for car traders importing vehicles to Romania. The tax structure can significantly impact your pricing strategy and profit margins.

Value Added Tax (VAT)

VAT is a major consideration when importing cars to Romania. The standard VAT rate in Romania is 19%. Here's what you need to know:

For used vehicles from within the EU, it depends on whether the vehicle is sold with VAT included or excluded. For example, the vast majority of cars sold on eCarsTrade are sold netto, which means VAT is excluded.

In this case, or if you're importing from outside the EU, you'll need to pay the full 19% VAT on the vehicle's customs value plus any import duties.

As a business, you may be able to reclaim this VAT if you're properly registered and the vehicles are for resale. Consult with a Romanian tax advisor to ensure you're following the correct procedures.

Environmental tax

Romania applies a registration tax based on the vehicle's CO2 emissions. This tax, known as the "Environmental Stamp" or "Timbrul de Mediu," varies depending on the emission level and engine capacity. The formula for calculating this tax is:

Tax = A x B x (100 - C)/100

Where: A = CO2 emissions in g/km B = Specific tax (€/1g CO2) based on the EURO emission standard C = Depreciation based on vehicle age

For example, a five-year-old Euro 5 car with 150g/km CO2 emissions might face a tax of around €300-400, but always check the current rates as they can change.

First registration fee

There's a one-time fee for the first registration of a vehicle in Romania. This fee is relatively small, usually around 60-100 lei, but it's mandatory for all imported vehicles.

Customs duty

While there's usually no customs duty for cars imported from within the EU, vehicles from outside the EU may face import duties. The rate can vary but is typically around 10% of the vehicle's value.

Step-by-step process - from purchasing a car to importing it to Romania

As a car trader, understanding the detailed process of importing a vehicle to Romania is crucial for your business. Here's a comprehensive, step-by-step guide to help you navigate this process efficiently:

1. Research and purchase the vehicle

Start by identifying vehicles that suit your business needs on online platforms like eCarsTrade.

At eCarsTrade, you can source vehicles from Belgium, France, the Netherlands or Germany.

Once you have found a car:

- Thoroughly inspect the vehicle by reading the descriptions and examining the photos

- Verify the car's history using its VIN number

- Ensure it meets at least Euro 5 emission standards

- Bid in auctions, buy at fixed prices our source from our stock

- Complete the purchase

Remember, your profit margin depends on buying at the right price, so be diligent in this step.

2. Gather necessary documents

Collect all required paperwork immediately after purchase:

- Original purchase invoice

- Certificate of Conformity (CoC)

- Original registration documents

If the car didn’t come with a Certificate of Conformity, this is the perfect time to get that sorted. Contact the car’s brand to ask if they can provide you with a COC or use an online service like EuroCOC.

Don’t forget that you will need to translate these documents into Romanian to complete the import and registration process.

3. Arrange transportation

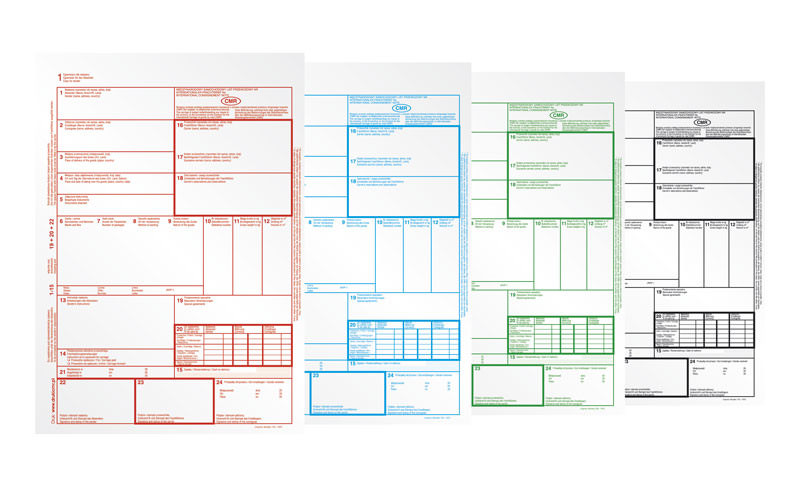

Decide how you'll bring the car to Romania. We usually recommend hiring a professional truct transport company who handles the transportation with a CMR.

Alternatively, platforms through which you are sourcing your cars might have their own delivery service.

We offer our eCarsTrade Delivery Service to traders who don’t want the hassle of finding a transport company themselves - we handle that for you and organize the transport of your vehicles straight to your parking lot!

Example of a CMR

4. Clear Romanian Customs

Before the car arrives in Romania you will need to file a customs declaration online through the Romanian Customs website

In the online form you will also need to provide estimated arrival time and entry point into Romania, and submit digital copies of your documentation translated into Romanian

This pre-notification can speed up the customs process upon arrival.

Once the vehicle reaches Romania, you will need to present all original documents to customs officials and pay any applicable customs duties.

5. Pay VAT and the environmental tax

Once customs clearance is complete, you will need to visit your local tax office (ANAF) and pay the required taxes, including VA, if applicable, and the environmental tax.

The amount of the environmental tax depends on the vehicle’s engine size, emissions norm, and age. Higher taxes apply to older vehicles with greater emissions, while newer, eco-friendly cars may qualify for reduced rates or exemptions.

Obtain proof of payment for all taxes and keep all receipts for the next steps in the process.

6. Obtain insurance

Before proceeding with registration, purchase the Romanian car insurance (at least third-party liability) and ensure the policy meets minimum legal requirements

7. Pass technical inspection

Now is the time to pass the Romanian technical inspection (inspecția tehnică periodică - ITP).

Book an appointment at an authorized ITP center. A successful ITP is crucial for registration, so don't skip any necessary repairs.

8. Register your vehicle

Visit the local vehicle registration office - Directia Regim Permise de Conducere si Inmatriculare a Vehiculelor (DRPCIV).

You will need to provide these documents:

- Sales invoice

- Original registration papers

- Proof of customs clearance

- Proof of payment of all import duties and taxes

- ITP certificate

- Insurance policy for the vehicle

- Identification documents

You will also need to pay a registration fee and an additional fee to receive the license plates.

Once the registration process is done, you will receive a registration certificate.

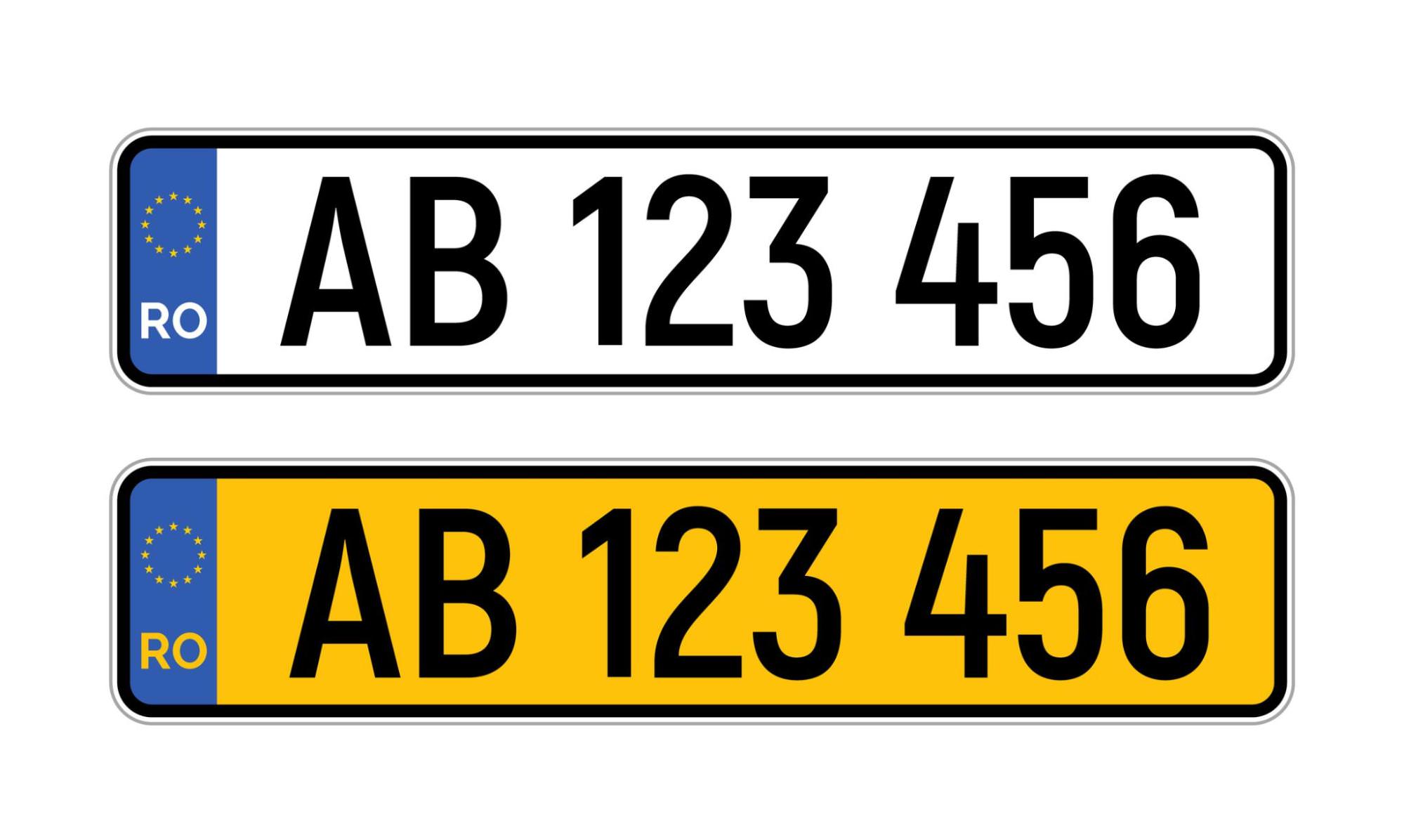

9. Receive Romanian plates

Once registration is approved, you can collect your registration certificate (Certificat de Înmatriculare) and new Romanian license plates.

Importing a car to Romania - FAQ

As a car trader, you're likely to encounter various questions and challenges when importing vehicles to Romania. Here are some frequently asked questions to help you navigate common issues:

► Can I import cars older than 10 years?

Yes, you can import older cars, but be aware of potential challenges. Vehicles over 10 years old may face higher taxes and stricter emissions scrutiny. They must still meet at least Euro 4 standards. Factor these additional costs into your pricing strategy.

► Do I need to translate all documents into Romanian?

Key documents like the Certificate of Conformity and vehicle registration certificate typically need certified Romanian translations. However, some EU-standard documents might be accepted in English. When in doubt, it's safer to have a certified translation ready.

► Are there any restrictions on the types of vehicles I can import?

While most EU-compliant vehicles can be imported, there are restrictions on right-hand drive cars and certain modified vehicles. Cars must meet minimum emissions standards (currently Euro 4). Always check current regulations, as they can change.

The road to success with car imports to Romania

Importing cars from the EU to Romania offers significant opportunities for informed car traders.

Success depends on understanding Romanian market preferences, navigating import regulations, and efficiently managing documentation and taxes.

While initially challenging, experience will streamline your operations. The Romanian used car market shows growth potential, especially for those offering quality vehicles at competitive prices.

By applying the strategies outlined in this guide, staying customer-focused, and adapting to market changes, you can build a thriving car import business in Romania. Remember, your success depends not just on importing skills, but on meeting the needs of Romanian buyers effectively.

Importing vehicles from Europe can be complex, but eCarsTrade is here to simplify the process. Learn how to: