- Blog

- Will Used Car Prices Drop in 2024? The Future of the Used Car Market

Will Used Car Prices Drop in 2024? The Future of the Used Car Market

Dive into a deep analysis on the state of the used and new car market in late 2023 and read our predictions for used car pricing in 2024.

It’s been a dynamic year for used car traders. We’ve seen sales grow and fall throughout 2023 and followed a slow, but sure recovery in the market. Will next year bring more favorable economic circumstances and more robust production? Will used car prices keep dropping in 2024?

Read our experts’ analysis and predictions to find out.

We’ll start by taking a closer look at the used car market in the final months of 2023 and then move on to an analysis of the new car market, especially the EV sector. The last section will provide you with three possible scenarios for used car pricing in 2024.

Let’s get into it.

Used Car Market Fluctuations in Late 2023

As we’re nearing the end of 2023, automotive professionals and used car traders are looking at a somewhat unstable used car market. September and October, in particular, witnessed a significant drop in sales, followed by a quick recovery.

To forecast how the market might behave next year, and if we can expect prices to continue dropping, it’s important to understand the current state of used car sales, so let’s do a quick month-on-month analysis.

September

Compared to the same period in 2022, September of 2023 saw a significant slowdown in used car trading activity. More specifically, the average time needed to sell a used car was longer, and demand was lower than the supply.

A month-on-month comparison also shows decreasing momentum. The sales-volume index (SVI), the metric that references the number of used vehicles sold in a given period, indicates lower sales for this month across many European markets, as reported by Autovista24:

- Italy (-34.5%)

- Spain (-15.7%)

- Austria (-11.6%)

- France (-11.5%)

- The UK (-10.7%)

- Germany (-4.5%)

Only Switzerland experienced higher sales in this period, with an 8.8% increase. With these sales numbers as they are, you won’t be surprised to know that supply was higher than demand for used car sales in September.

October

It seems that the low sales figures from September weren’t indicative of a growing trend. Used car trading picked up in October and showed some robust growth. According to another Austovista report, this was evident in multiple markets, including the ones that saw decreased activity in September.

And these weren’t low figures either. For example, Italy showed a 64.9% rise, and France followed close behind at 52.2%.

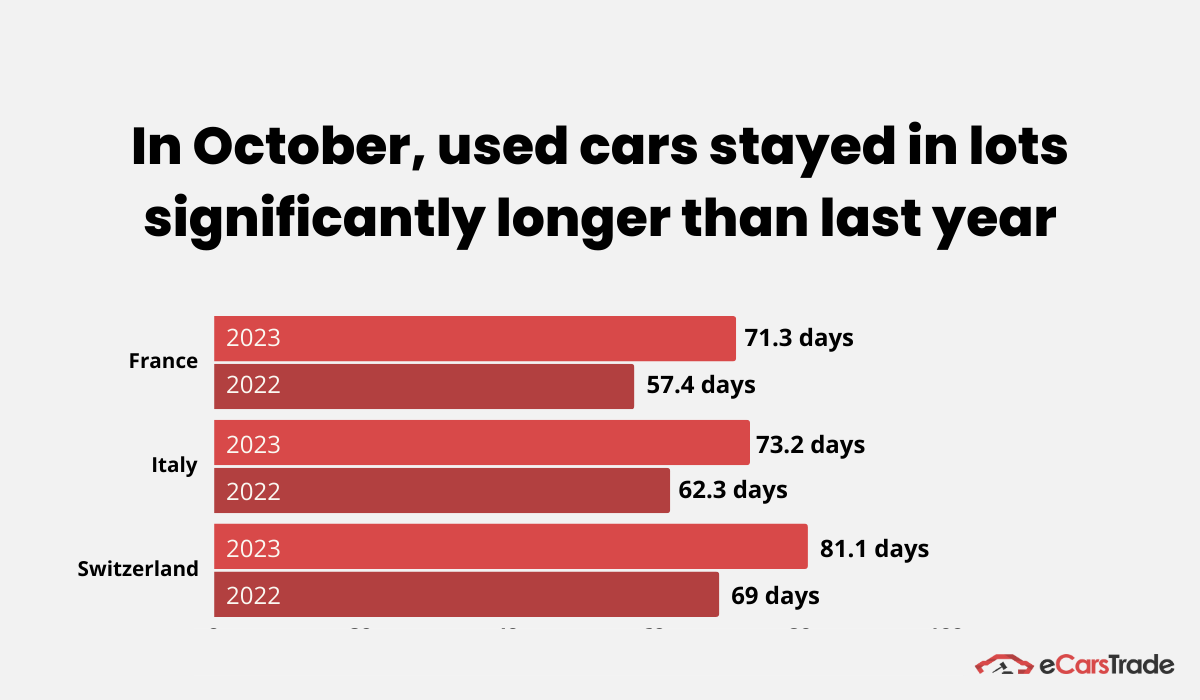

During this period, demand was also on the rise, and it exceeded supply across multiple markets. However, this rise wasn’t very obvious and stayed in the single-digit number in most places. Additionally, used cars stayed in their lots longer as it took more time, on average, for them to be sold than in September. For example, in France, the number of days needed to sell a used car climbed up to 71.3 days (that figure was 65.5 in the previous month). The year-on-year change is even more dramatic, as you can see in the comparison below.

Illustration: eCarsTrade / Data: Autovista24

Other markets, such as Italy, experienced similarly longer days-to-sale periods.

November

Another dip in sales came in the month of November. Only France and Spain showed an improved sales-volume index (9.9% and only 0.2%, respectively) while other countries experienced lower sales when compared to October.

The trend of longer sales periods also continued, especially from a year-on-year perspective. This was most pronounced in France (14.6 additional days), Spain (10.7 days) and Switzerland (8.6 days). In the same period, supply outpaced Austria, Germany, Italy, Switzerland, and the UK to bring used car sellers positive business results.

What can these market fluctuations tell us? Well, that’s going to be difficult to accurately predict used car pricing for next year because the market is currently unstable.

However, the overall (slow) growth trend in sales that we’ve witnessed throughout the year gives us reason to believe prices will, indeed, be slightly dropping in 2024.

Let’s now turn to the new car market and its current state to find more clues about what we can expect in 2024.

The New Car Market in Late 2023

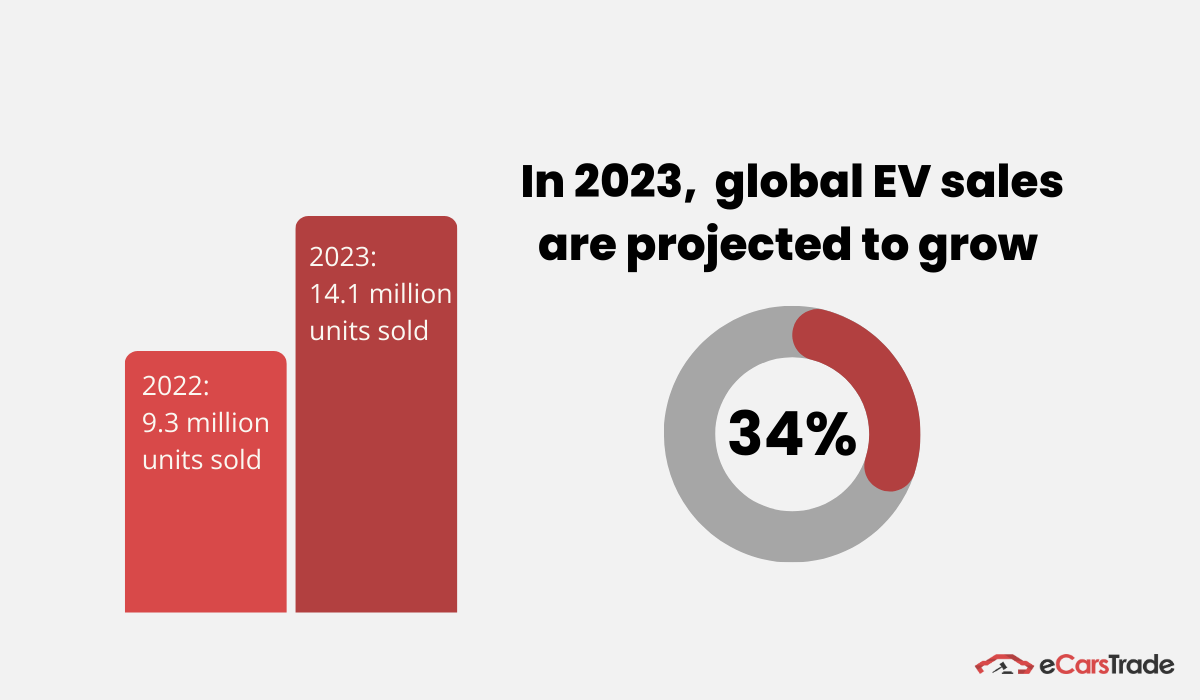

On the new car market front, sales have been steadily growing for a while now. This trend has largely been fueled by electric vehicle (EV) sales. In fact, current estimates put plug-in hybrid and battery electric vehicle sales at 14.1 million units by the end of 2023. That’s an increase of as much as 34% compared to 2022.

Illustration: eCarsTrade / Data: Autovista24

There’s more than one reason for this commercial success.

On one hand, the troubles that have been slowing down EV production have been easing since the end of the pandemic. In practical terms, this means supply chain issues are on the way to be resolved and EV producers are finding ways to diversify their supply practices when it comes to car parts, battery components, and semiconductors.

A steadier supply of materials translates into steadier production and more car availability for consumers who won’t have to wait as long for their cars. For now, things are looking well for the new car market, even if the recovery is gradual and slow.

Furthermore, supply chain stability and material availability is reducing the price of EVs. For instance, some estimates say the price of batteries will fall to between approx. €55 and €85 per kWh until the end of the decade (it was approx. €140 per kWh in 2022). This could bring EV prices to the same level ICEs in just a couple of years. But bear in mind, these predictions are a little further off than 2024.

On the other hand, we should always be conscious of the fact that ICE vehicles are being phased out from the EU. According to legislation, by 2035, all new passanger cars and light-commercial vehicles in the EU must be zero-CO2 emission, which, for the most part, means electric. To facilitate this change, countries have systems of incentives for buying EVs, as well as increasingly stringent regulations on emissions.

For those reasons, EVs are becoming the logical choice for the new car buyer, and chances are they will win the market even before the 2035 deadline.

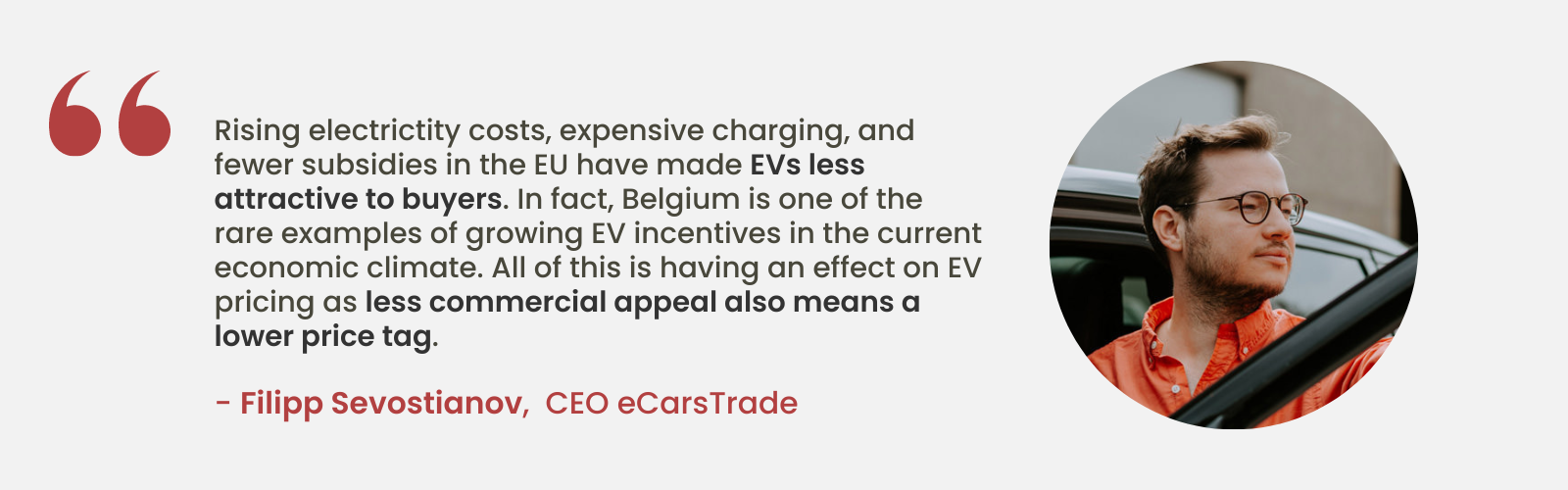

However, EVs have also encountered challenges lately as countries such as Germany, France and The Netherlands phase out EV incentives.

Can we expect used car prices to go down?

Firstly, the slow market recovery means waiting times are still relatively long. Current economic pressures are making buyers decide on used instead of new cars, leading to high demand which is also keeping prices high.

However, the future seems bright. As leftover pandemic supply issues ease and EVs become cheaper, opportunities for remarketing will grow as car availability increases. Lower prices should follow not long after that.

Will this scenario play out in 2024? That remains to be seen.

The Used Car Market in 2024: Three Possible Scenarios

In this article, we frequently mentioned that the used car market is in a state of flux, reflecting the wider economic circumstances of this period. Some indicators paint a picture of recovery and market growth, while others warn that we’re not yet clear of the crises caused by the pandemic and recent geopolitical conflicts.

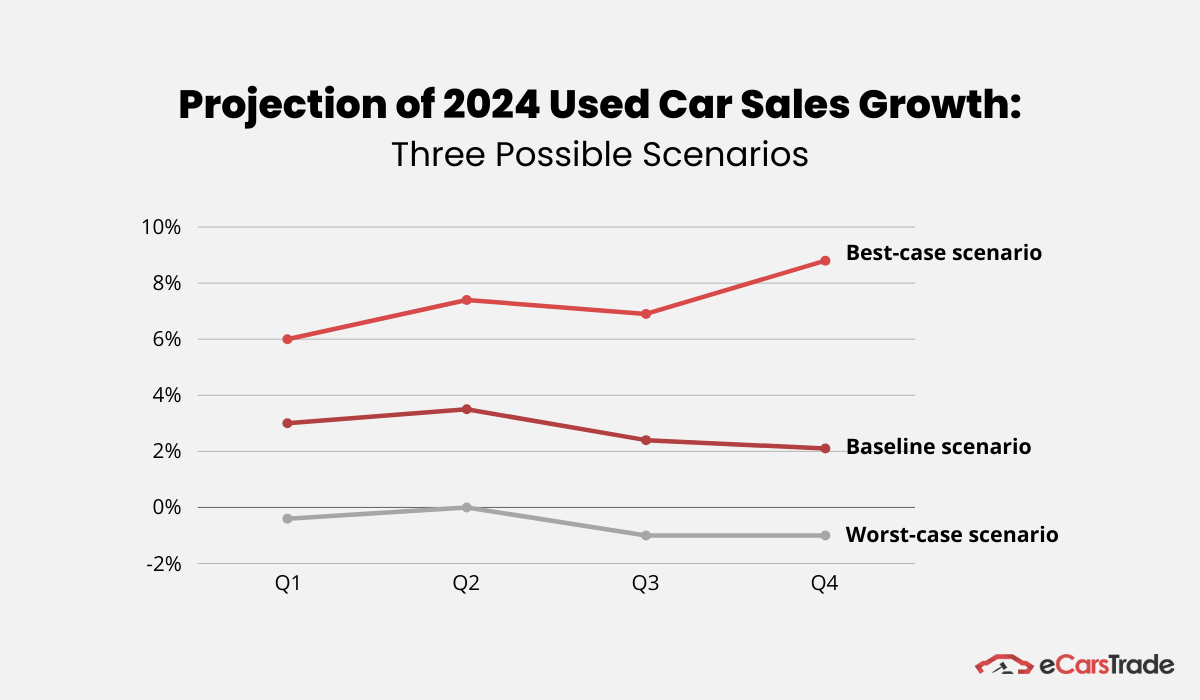

Cox Automotive recently published an extensive report about their 2024 predictions - Cox Automotive Insight Report 2023/2024 - in which they analyze in detail what will be happening on both used and new car markets in 2024. They theorize about three possible scenarios for the how the used car market will grow.

Illustration: eCarsTrade / Data: Cox Automotive

As you can see above, the best-case scenario sees some strong used car sales growth in the sector, capping at almost 9% in Q4 of 2024. On the downside, the worst case scenario sees the market shrinking, with negative growth up to one whole percentage point.

Let’s analyze each forecast more closely.

Best-Case Scenario

In late 2023, we have seen that the used car market can indeed show very positive sales figures, as we saw in our October analysis. Therefore, it’s quite possible that these results will be repeated in 2024, with even stronger activity.

In its most positive scenario, Cox Automotive predicts a robust year-on-year increase in sales, a figure higher than 7% when compared to 2023. In this prediction, sales will grow gradually throughout the year.

How do we get there? In truth, this scenario is only possible if inflation eases quite strongly and EV production stays high throughout the year, unburdened by supply issues and the cost of materials.

These circumstances would make interest rates lower, making it easier for buyers to borrow money to buy in a market where there are enough cars to keep waiting times low and car options varied. This boost in supply over demand and cost-effectiveness of loans would definitely bring car prices down in both the new and used markets.

Baseline Scenario

The most realistic prediction for used car sales numbers in 2024 is that we’re going to see a continuation of the current situation: a slow recovery of the market that’s going to allow for slight decreases in pricing.

In this scenario, two opposing forces will work against each other with the result of keeping pricing relatively stable. The first one is the easing of supply chain issues and lower car part prices. This on its own would bring used car prices down, were it not for the high inflation that would, in this case, continue to affect buying power across all sectors, including automotive.

This prediction puts year-on-year growth at 2.3%, a figure that would be reflected in prices falling slightly in both the new and used car markets, at least in the first half of the year.

Reason enough for resellers to be hopeful if they rotate their stock fast in order to benefit from decreasing prices.

Worst-Case Scenario

The worst-case scenario sees economic circumstances deteriorate further with failure to reign in inflation and a worsening cost-of-living crisis. If this happens, not even very robust car production will be able to help buyers access the used car market because their confidence in safely buying vehicles will be shaken, with less consumers deciding to buy cars.

In this scenario, high interest rates and high cost of living make financing used cars much more difficult. This low demand paired with low prices presents a risk but also a potential opportunity for traders, as it creates room for less competition and interesting purchase deals.

Cox Automotive predicts a slight contraction of the market for this scenario, at -0.6%. However, it’s going to be difficult to reverse the steady market recovery we’ve been seeing throughout 2023, especially it’s last quarters, so this scenario isn’t very probable.

All things taken into consideration, we can expect used car pricing to drop in 2024, although not drastically, but the volumes will rise. This is still good news for traders, as it means plenty of room for opportunities in terms of purchasing deals.

Used car dealers have much to look forward to in a more long-term perspective as EVs catch up to ICEs in pricing and unfavorable economic circumstance, mainly inflation, get resolved.

Will Used Car Prices Drop in 2024?

Current market fluctuations, as we have seen in the first section of this blog post, are making future pricing difficult to predict. The sector is recovering from serious challenges, such as supply chain issues, energy concerns and a high inflation, and this recovery can be slow and uncertain.

However, the further out we look, the brighter the outlook becomes, with the European Central bank indicating that interest rates will not be increasing and long-term interest rates going down.

These external factors might be outside of your control, but car traders will always be able to find interesting opportunities within each of these scenarios. You simply have to be flexible and adjust to the market changes in order to find good deals. And don’t forget - we’re here to help!

The eCarsTrade platform empowers you to bid on cars from multiple European markets to secure best pricing, so take a look at our selection of thousands of used cars and start making some smart buying choices today.